In previous posts, we have covered the basics of Twitter that make it different from other social media. And we offered reasons why businesses ought to strongly consider making Twitter part of their overall social media effort. Now we take a deeper dive into some tactics to help you leverage the platform for your small- or medium-sized business. Staying with last year’s “Twitter Do’s and Don’ts” format, we proclaim some best practices and puncture some not-so-good ones.

For selections from our previous Twitter coverage, go here for our previous Twitter Do’s and Don’ts Column, and here for our Twitter for Business primer.

Actually spend time on the platform. There’s no substitute for spending time on Twitter. That might seem too obvious to mention, but we see Twitter postings by individuals who seem to have virtually no acquaintance with the network itself, or its ways. We also see accounts in which the feed is entirely content that is auto-shared from the business’s Facebook account, or its Instagram account, or some other social medium. It’s plain to see that no human being had anything to do, directly, with that company’s Twitter account, to the point that you might wonder why the company even bothers. It doesn’t take much acquaintance with Twitter to realize that the medium is a community, and that a conversation is going on. As we say in one of our other blog posts (the second of the two links shared above), Twitter is essentially a chat room.

Actually spend time on the platform. There’s no substitute for spending time on Twitter. That might seem too obvious to mention, but we see Twitter postings by individuals who seem to have virtually no acquaintance with the network itself, or its ways. We also see accounts in which the feed is entirely content that is auto-shared from the business’s Facebook account, or its Instagram account, or some other social medium. It’s plain to see that no human being had anything to do, directly, with that company’s Twitter account, to the point that you might wonder why the company even bothers. It doesn’t take much acquaintance with Twitter to realize that the medium is a community, and that a conversation is going on. As we say in one of our other blog posts (the second of the two links shared above), Twitter is essentially a chat room.

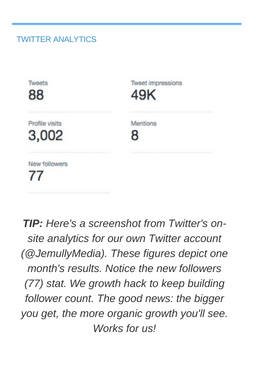

Expect organic growth (of followers). One piece of advice I received has proven to be invaluable. It is, “organic growth is almost always a lie.” The illusion is that you create an account on Twitter and you begin putting out appealing messages and people are attracted to you and the following just keeps building. But the reality is that you must get in there and “growth hack.” The illusion does occasionally become the reality for celebrities and entities with established reputations. For the rest of us, it is work to get a following. But it is worth it. Use a “follow first” tactic. Follow accounts who would make good followers for you. Give them time to follow you back, but if, say, months go by and they haven’t followed you, then unfollow them. Rinse and repeat.

Expect organic growth (of followers). One piece of advice I received has proven to be invaluable. It is, “organic growth is almost always a lie.” The illusion is that you create an account on Twitter and you begin putting out appealing messages and people are attracted to you and the following just keeps building. But the reality is that you must get in there and “growth hack.” The illusion does occasionally become the reality for celebrities and entities with established reputations. For the rest of us, it is work to get a following. But it is worth it. Use a “follow first” tactic. Follow accounts who would make good followers for you. Give them time to follow you back, but if, say, months go by and they haven’t followed you, then unfollow them. Rinse and repeat.

Have a website. Most business people reading this blog right now already have a company website. But just in case you don’t, it’s worth saying it here: you really ought to have a website if you are going to invest time on Twitter. You’re trying to build your brand, right? As you build up all this good will and branding and buzz on Twitter, where does your prospective customer go to cement a relationship, or to initiate the purchasing process? It can’t all be done on Twitter. Your website should be the hub of all your marketing efforts. Social media like Twitter should be a marketing outreach effort that funnels people to your site. Customers need more than just a place (Twitter) where they can be messaged and cultivated. They need a domain where they can do business with you. So get your website up and get your Twitter account linked to your site, and vice versa, to maximize your efforts.

Have a website. Most business people reading this blog right now already have a company website. But just in case you don’t, it’s worth saying it here: you really ought to have a website if you are going to invest time on Twitter. You’re trying to build your brand, right? As you build up all this good will and branding and buzz on Twitter, where does your prospective customer go to cement a relationship, or to initiate the purchasing process? It can’t all be done on Twitter. Your website should be the hub of all your marketing efforts. Social media like Twitter should be a marketing outreach effort that funnels people to your site. Customers need more than just a place (Twitter) where they can be messaged and cultivated. They need a domain where they can do business with you. So get your website up and get your Twitter account linked to your site, and vice versa, to maximize your efforts.

Create automated direct messages. Yes, we know that most of the advice you see out there recommends that you auto-DM all your new followers. But forget that. Those who are reading this who are very active on Twitter already know what I’m about to say: that an automated DM—dispatched to you from an account you followed yesterday—is the equivalent of social media junk mail. Yes, we know you want us to visit your website. We all know you have a great download you want to offer us. Thanks.

Create automated direct messages. Yes, we know that most of the advice you see out there recommends that you auto-DM all your new followers. But forget that. Those who are reading this who are very active on Twitter already know what I’m about to say: that an automated DM—dispatched to you from an account you followed yesterday—is the equivalent of social media junk mail. Yes, we know you want us to visit your website. We all know you have a great download you want to offer us. Thanks.

Follow the Giants. If it’s a huge Twitter account and it’s a firehose tweeter and it doesn’t really follow others (rarely follows others), don’t follow them, list them (put them on a Twitter list that you can look at only as needed). This keeps your feeds cleaner.

Follow the Giants. If it’s a huge Twitter account and it’s a firehose tweeter and it doesn’t really follow others (rarely follows others), don’t follow them, list them (put them on a Twitter list that you can look at only as needed). This keeps your feeds cleaner.

Retweet your own posts. This is different from repetitive scheduling. Repetitive scheduling is most efficiently done in a site such as Buffer or Hootsuite. A self-retweet (a retweet of one of your own posts, not of someone else’s) gets additional mileage out of a post. Simply scroll down through your past feed, looking for good past efforts with messages that are still valid, and hit the “retweet” icon.

Retweet your own posts. This is different from repetitive scheduling. Repetitive scheduling is most efficiently done in a site such as Buffer or Hootsuite. A self-retweet (a retweet of one of your own posts, not of someone else’s) gets additional mileage out of a post. Simply scroll down through your past feed, looking for good past efforts with messages that are still valid, and hit the “retweet” icon.

Expect engagement while you’re still on the lower end of the scale, when it comes to followers. You’ll need to have a thousand followers before you get significant “follower” engagement. But remember that engagement isn’t everything. Even when you’re seeing no engagement at all (on your content), you can still be doing good for yourself.

Expect engagement while you’re still on the lower end of the scale, when it comes to followers. You’ll need to have a thousand followers before you get significant “follower” engagement. But remember that engagement isn’t everything. Even when you’re seeing no engagement at all (on your content), you can still be doing good for yourself.

Think of Twitter as a backlink wonderland. Search engines like Google monitor positive social signals even if the general consensus is that social media links are considered “nofollow.” Even if the possibility that the social links don’t count toward your ranking, the number of likes, retweets and shares will impact rankings. Search algorithms routinely crawl social media analyzing these signals. Don’t forget that the job of search engines is to deliver helpful content.

Think of Twitter as a backlink wonderland. Search engines like Google monitor positive social signals even if the general consensus is that social media links are considered “nofollow.” Even if the possibility that the social links don’t count toward your ranking, the number of likes, retweets and shares will impact rankings. Search algorithms routinely crawl social media analyzing these signals. Don’t forget that the job of search engines is to deliver helpful content.

Neglect to be reciprocal. Don’t try to be a one-way street with your communications. You’re wanting shares, right? You’d like for your followers to engage with your content, and to retweet it, and spread the good news about your business, right? So ask yourself, are you not willing to retweet anything of theirs in your own feed? And if so, then how realistic is that? Sure, the giants of Twitter get away with it. The mega-corporations get away with it. But for those who lack that kind of cachet, there’s no substitute for joining the community and being reciprocal. Twitter is a community. You’ll be appreciated for your reciprocity.

Neglect to be reciprocal. Don’t try to be a one-way street with your communications. You’re wanting shares, right? You’d like for your followers to engage with your content, and to retweet it, and spread the good news about your business, right? So ask yourself, are you not willing to retweet anything of theirs in your own feed? And if so, then how realistic is that? Sure, the giants of Twitter get away with it. The mega-corporations get away with it. But for those who lack that kind of cachet, there’s no substitute for joining the community and being reciprocal. Twitter is a community. You’ll be appreciated for your reciprocity.

Spend some money on Twitter. It gets you noticed. A little lettuce makes the world go ’round. Just ask Facebook.

Spend some money on Twitter. It gets you noticed. A little lettuce makes the world go ’round. Just ask Facebook.

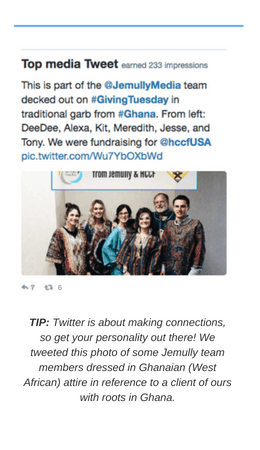

Talk to one person and tie up the masses. It’s okay on occasion to issue an @reply to one follower—a reply that posts in your feed. Sometimes it can be a way of showing your own personality. But if much of that sort of thing needs to be done, do it via direct messaging.

Talk to one person and tie up the masses. It’s okay on occasion to issue an @reply to one follower—a reply that posts in your feed. Sometimes it can be a way of showing your own personality. But if much of that sort of thing needs to be done, do it via direct messaging.

Resist the urge to automate. Too much automation is just absentee-ism. Go back to point 1. Spend time on Twitter.

Resist the urge to automate. Too much automation is just absentee-ism. Go back to point 1. Spend time on Twitter.

Overlook Twitter’s “advanced search” function when you’re practicing your “follow first” growth hacking. Access it from your home page by typing a word into the search bar. When you hit “return” (or “enter”), you’ll get a fresh screen and on the upper left side you’ll see the words “Search filters,” with the option to “show” those. Click “show.” You’ll get a menu for more search parameters, but skip those and click the words “Advanced search.” Try that, and filter it, as you bring up fresh results, to reveal profiles, not tweets. You can really narrow down the kinds of follower prospects you view, and this will help you attract just exactly the kinds of followers you want.

Overlook Twitter’s “advanced search” function when you’re practicing your “follow first” growth hacking. Access it from your home page by typing a word into the search bar. When you hit “return” (or “enter”), you’ll get a fresh screen and on the upper left side you’ll see the words “Search filters,” with the option to “show” those. Click “show.” You’ll get a menu for more search parameters, but skip those and click the words “Advanced search.” Try that, and filter it, as you bring up fresh results, to reveal profiles, not tweets. You can really narrow down the kinds of follower prospects you view, and this will help you attract just exactly the kinds of followers you want.

Create graphics. Find more on that angle by visiting this post.

Create graphics. Find more on that angle by visiting this post.

Have dupe tweets, or highly similar tweets, displayed in your feed consecutively.

Have dupe tweets, or highly similar tweets, displayed in your feed consecutively.

Conduct Twitter polls to stimulate some interaction and conversation. And to generate some data that you can analyze and convert into useful content.

Conduct Twitter polls to stimulate some interaction and conversation. And to generate some data that you can analyze and convert into useful content.

Spend a lot—not at first. Don’t spend on promoted tweets and don’t pour time (and money) into analytics and tools until you’ve put the apparatus in place to capitalize on those expenditures and get your money back out of them. Do some serious content creation first, paired with some serious growth hacking. And create a bevy of backlinks. Once you get some traction in the Twittersphere, then it might be time to start spending. We see too many people spending on Twitter when they have fewer than 100 followers and very little content in their feed. Whoever is advising them is doing them a disservice. The same indictment goes, in a different sphere, for digital agencies that sell a $500-a-month (or more) SEO package to clients who have only five pages on their website, and no blog. How on Earth can someone justify that degree of monthly expense when there’s so little content to benefit from it? While we’re at it—the same goes for agencies that charge for “blogging” and then put a mere paragraph on a page for a client and call that a blog post. Do customers really know what is going on? (Rant over! But remember, all of this internet biz is interconnected.) Make sure you know what you are getting for your money, and with Twitter, that means having an audience of followers to receive your tweets.

Spend a lot—not at first. Don’t spend on promoted tweets and don’t pour time (and money) into analytics and tools until you’ve put the apparatus in place to capitalize on those expenditures and get your money back out of them. Do some serious content creation first, paired with some serious growth hacking. And create a bevy of backlinks. Once you get some traction in the Twittersphere, then it might be time to start spending. We see too many people spending on Twitter when they have fewer than 100 followers and very little content in their feed. Whoever is advising them is doing them a disservice. The same indictment goes, in a different sphere, for digital agencies that sell a $500-a-month (or more) SEO package to clients who have only five pages on their website, and no blog. How on Earth can someone justify that degree of monthly expense when there’s so little content to benefit from it? While we’re at it—the same goes for agencies that charge for “blogging” and then put a mere paragraph on a page for a client and call that a blog post. Do customers really know what is going on? (Rant over! But remember, all of this internet biz is interconnected.) Make sure you know what you are getting for your money, and with Twitter, that means having an audience of followers to receive your tweets.

Create a Recommendables list. (That is, create a list and name it “Recommendables.” Then add such accounts to it as seem most fitting.) Later, when you’re ready, tweet about the accounts you want to recommend. You’ll make yourself a hero to the accounts you recommend, and in the recommendation process you’ll be providing a service to all of your following. If you maintain this list as a private list, then your recommendations, when you share them, will be fresh news to your viewers.

Create a Recommendables list. (That is, create a list and name it “Recommendables.” Then add such accounts to it as seem most fitting.) Later, when you’re ready, tweet about the accounts you want to recommend. You’ll make yourself a hero to the accounts you recommend, and in the recommendation process you’ll be providing a service to all of your following. If you maintain this list as a private list, then your recommendations, when you share them, will be fresh news to your viewers.

Create a Retweetables list and make it private. Recommendables are accounts I list that I want to later recommend to others. But retweetables are accounts that are consistently worth hearing from, and, accordingly, worth retweeting. With some regularity. Not every account out there is highly retweetable. Do you have some prospects out there—companies that you’d love to do business with? Are they on Twitter? Follow them and list them, too, in your Retweetables list. Any list, when opened, displays a feed. Pop open that feed every week and just see what’s being said in it. Hit the retweet buttons on the tweets that seem best for your purposes. Now you’ve put yourself into the Notifications tab for those accounts that you retweeted. They’ve been “flagged,” essentially, and when they open their notifications they’ll see you’ve done something good for them. Over time this can only help your marketing efforts.

Create a Retweetables list and make it private. Recommendables are accounts I list that I want to later recommend to others. But retweetables are accounts that are consistently worth hearing from, and, accordingly, worth retweeting. With some regularity. Not every account out there is highly retweetable. Do you have some prospects out there—companies that you’d love to do business with? Are they on Twitter? Follow them and list them, too, in your Retweetables list. Any list, when opened, displays a feed. Pop open that feed every week and just see what’s being said in it. Hit the retweet buttons on the tweets that seem best for your purposes. Now you’ve put yourself into the Notifications tab for those accounts that you retweeted. They’ve been “flagged,” essentially, and when they open their notifications they’ll see you’ve done something good for them. Over time this can only help your marketing efforts.

Neglect the fact that being on Twitter helps your website’s SEO, provided that you are creating backlinks from Twitter to your website. According to Socialmediatoday.com, “Google looks for backlinks and page content, and individual social posts and profiles are considered the same as any other webpage that Google can index. That means that if you have a lot of people visiting your social profiles and content, they can individually rank in search. In fact, for a lot of entities, you’ll find a Twitter profile, in particular, will show up high in search results (this has been helped by the fact that Twitter and Google have an agreement to index tweets).” The site went on to note that “That Google/Twitter deal can also help your tweets rank, individually, and a study of more than 900,000 tweets published earlier this year showed that tweets with more Likes do have a better chance of ranking higher in Google results.” Read the whole report here.

Neglect the fact that being on Twitter helps your website’s SEO, provided that you are creating backlinks from Twitter to your website. According to Socialmediatoday.com, “Google looks for backlinks and page content, and individual social posts and profiles are considered the same as any other webpage that Google can index. That means that if you have a lot of people visiting your social profiles and content, they can individually rank in search. In fact, for a lot of entities, you’ll find a Twitter profile, in particular, will show up high in search results (this has been helped by the fact that Twitter and Google have an agreement to index tweets).” The site went on to note that “That Google/Twitter deal can also help your tweets rank, individually, and a study of more than 900,000 tweets published earlier this year showed that tweets with more Likes do have a better chance of ranking higher in Google results.” Read the whole report here.

Retweet others for the purpose of dividing up and spacing out your original tweets in your own feed, especially if you are worried about not having enough variety in your messaging. This helps, too, if you have concerns about some repeated tweets falling too close together in your own feed. Most people aren’t looking at your feed and critiquing it. It’s natural to think that they are. Generally, users are just looking at their own feeds. Just the same, you won’t want your tweetstream to have an unappealing and unvaried look.

Retweet others for the purpose of dividing up and spacing out your original tweets in your own feed, especially if you are worried about not having enough variety in your messaging. This helps, too, if you have concerns about some repeated tweets falling too close together in your own feed. Most people aren’t looking at your feed and critiquing it. It’s natural to think that they are. Generally, users are just looking at their own feeds. Just the same, you won’t want your tweetstream to have an unappealing and unvaried look.

Put all your links at the end of all your tweets. Statistics show that you’ll get maximum engagement when you put links one-fourth of the way into the tweet.

Put all your links at the end of all your tweets. Statistics show that you’ll get maximum engagement when you put links one-fourth of the way into the tweet.

Follow @TwitterBusiness. Better yet, list them instead of merely following them. And the same with @JemullyMedia to get tips not just about Twitter, but about the main social media platforms and digital marketing in general.

Follow @TwitterBusiness. Better yet, list them instead of merely following them. And the same with @JemullyMedia to get tips not just about Twitter, but about the main social media platforms and digital marketing in general.

What Twitter best practices do you swear by? We’d love to know!